About Scarborough Mortgage Broker

Wiki Article

See This Report about Mortgage Broker Scarborough

Table of ContentsThe 3-Minute Rule for Mortgage Broker ScarboroughAbout Mortgage Broker In ScarboroughFascination About Mortgage BrokerMortgage Broker - An OverviewA Biased View of Mortgage Broker ScarboroughIndicators on Mortgage Broker Near Me You Need To Know

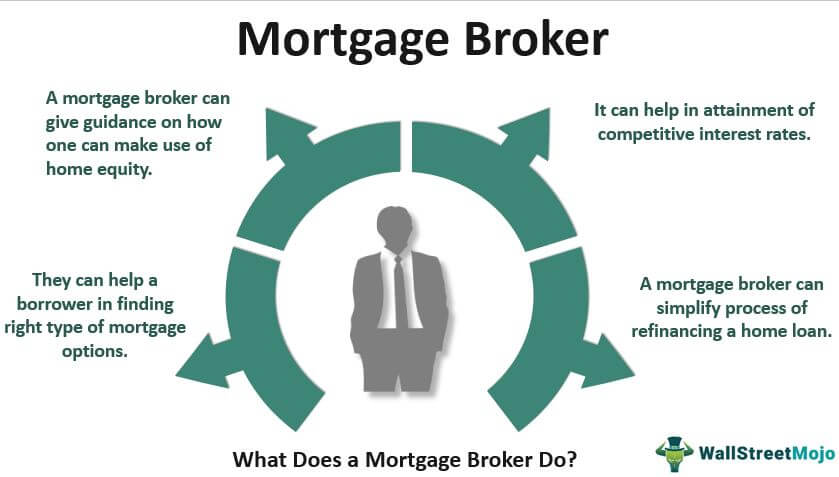

What Is a Home loan Broker? The mortgage broker will function with both parties to obtain the private authorized for the lending.A home mortgage broker typically works with lots of different lending institutions and also can provide a range of lending options to the customer they function with. The broker will certainly accumulate details from the private and go to several lenders in order to find the ideal prospective loan for their client.

The Bottom Line: Do I Required A Home Mortgage Broker? Functioning with a home mortgage broker can conserve the borrower time as well as initiative throughout the application process, and also potentially a whole lot of money over the life of the lending. Additionally, some lenders function solely with home loan brokers, meaning that customers would certainly have accessibility to financings that would certainly or else not be available to them.

Not known Facts About Mortgage Broker In Scarborough

It's vital to check out all the fees, both those you could need to pay the broker, along with any charges the broker can aid you avoid, when weighing the decision to collaborate with a home mortgage broker.

What is a home mortgage broker? A mortgage broker acts as an intermediary between you and also possible lenders. Home mortgage brokers have stables of loan providers they function with, which can make your life easier.

Mortgage Broker Fundamentals Explained

Just how does a mortgage broker make money? Home mortgage brokers are usually paid by lenders, often by consumers, but, by legislation, never ever both. That law the Dodd-Frank Act Restricts home mortgage brokers from billing surprise costs or basing their settlement on a borrower's rate of interest price. You can additionally choose to pay the home loan broker on your own.

Home mortgage brokers might be able to give borrowers access to a broad selection of lending types. You can save time by making use of a home mortgage broker; it can take hrs to use for preapproval with different lending institutions, after that there's the back-and-forth communication involved in financing the loan and making certain the transaction remains on track.

What Does Mortgage Broker Near Me Do?

Yet when selecting any lender whether through a broker or straight you'll desire to focus on lender charges. Particularly, ask what charges will appear on Web page 2 of your Funding Quote kind in the Lending Expenses area under "A: Source Charges." After that, take the Finance Price quote you receive from each loan provider, place them side-by-side and contrast your rates of interest and all of the charges and closing costs.5. mortgage broker in Scarborough. Just how do I pick a home mortgage broker? The very best means is to ask buddies and relatives for referrals, however see to it they have in fact utilized the broker and also aren't simply going down the name of a former college flatmate or a far-off colleague. Discover all you can regarding the broker's solutions, communication style, level of understanding and also technique to customers.

Ask your representative for the names of a couple of brokers that they have actually collaborated with and also depend on. Some property firms provide an internal home mortgage broker as part of their suite of services, however you're not bound to go with that business or person. Discovering the ideal mortgage broker is just like choosing the best home mortgage loan provider: It's a good idea to talk to a minimum of three people to learn what solutions they supply, just how much experience they have as Learn More well as just how they can assist simplify the procedure.

See This Report about Mortgage Broker

Frequently asked concerns, What does a mortgage broker do? A home loan broker finds loan providers with lendings, rates, and also terms to fit your demands.

Competition and house rates will certainly affect just how much mortgage brokers make money. What's the distinction in between a mortgage broker and a funding officer? Mortgage brokers will certainly function with lots of loan providers to find the very best loan for your circumstance. Car loan police officers work for one lending institution. How do I find a home loan broker? The most effective way to discover a mortgage broker article source is through referrals from family members, pals and your real estate agent.

Getting a brand-new house is one of the most complicated events in a person's life. Characteristic vary greatly in regards to design, services, institution area and, certainly, the always essential "place, location, location." The home mortgage application process is a complex aspect of the homebuying process, particularly for those without past experience - mortgage broker Scarborough.

Our Scarborough Mortgage Broker Statements

Report this wiki page